WHAT IS LEVERAGE AND MARGIN ?

DEFINING HOW TO TRADE

WITH FXLINK CORPORATION

One of the main appealing factors about forex trading is the use of Leverage & Margin. It allows you to use a small amount of capital to open and maintain a much larger position.

For example, if you want to open a trade of $100,000 worth of EURUSD, you don’t have to have that $100,000 dollars in your account!

WHAT IS LEVERAGE ?

Technically, leverage is where a trader has a large sum at their disposal while using a significantly smaller amount of their own funds. They effectively borrow the rest from their broker.

For example, if you’re trading with a 1:100 leverage, and you have $1,000 USD in your account, you’ve got $100,000 available for trading. Although this sounds like an insanely good opportunity, you must always remember that it’s a double-edged sword.

When you trade with a larger amount, as leverage enables you to do, you can open bigger positions and potentially earn larger profits. However, with bigger positions you also have a higher risk whereby your losses could also be larger.

WHAT IS MARGIN?

It may be easier to understand if you think of the margin as a deposit for the trade that you want to open and maintain. The broker that you’re trading with will keep a portion of your balance to cover the potential loss of that trade. Once you close the position, the margin will be put back into your account.

The margin that you need for a trade is normally expressed as a percentage of the whole trade and is called the ‘Margin requirement’. You’ll be given a margin requirement for every trade that you open, and it will vary depending on the instrument that you trade and the broker that you choose to trade with.

HOW DO YOU CALCULATE

THE MARGIN REQUIREMENT?

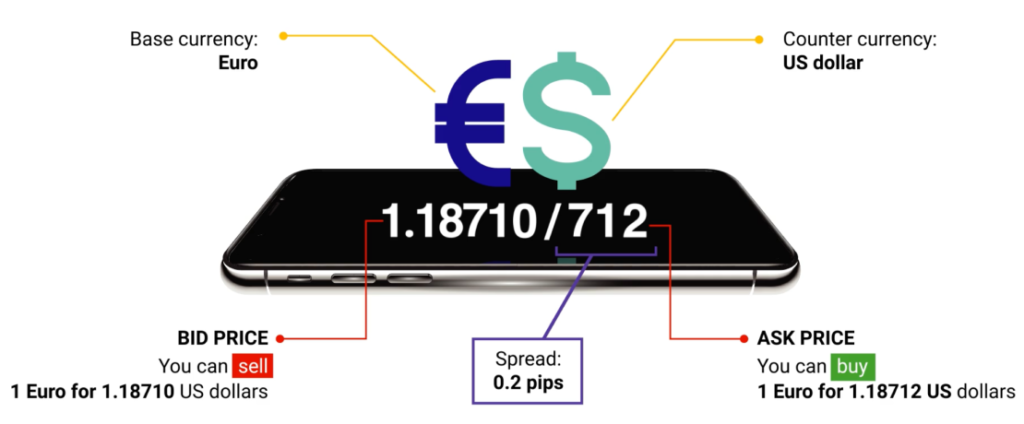

The required margin amount will be a percentage of the trade size you want to open and is calculated in the base currency of the trading pair you want to trade. Using the equation below, you can work out how much margin you will need for each trade.

Required Margin = Position Size X Margin Requirement

Example: You want to open a mini lot (10,000 base units) in USDJPY. How much margin do you need to open a position? Since USD is the base currency, the position size (or notional value) is 10,000 USD. Your broker has given you a Margin Requirement of 5%.

START TRADING

IN 4 STEPS

CFDs are complex instruments,and there is a high risk of losing money.

Register 🠖

Apply for your FXLINK Direct

Verify 🠖

Submit your ID and Proof of Residency and get verified

Fund

Deposit Funds in your live account

Trade

Enjoy being a part of the global financial markets

Tiếng Việt

Tiếng Việt Malaysia

Malaysia Français

Français 中文 (中国)

中文 (中国) ភាសាខ្មែរ

ភាសាខ្មែរ Bahasa Indonesia

Bahasa Indonesia Español

Español ไทย

ไทย