LIVE

RX RATES

Knowing the transaction costs associated with your trading

FOREX SPREADS

When you begin trading

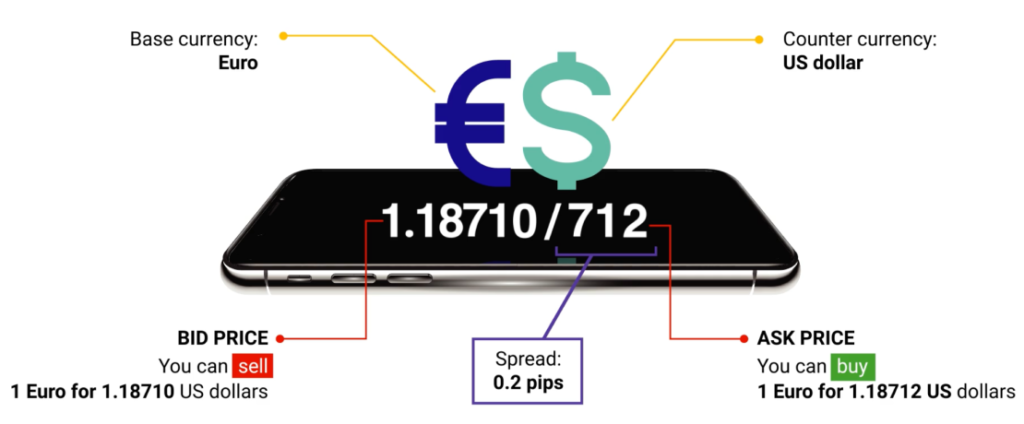

You’ll notice that you’re given a ‘bid’ (or ‘sell’) price and an ‘ask’ (or ‘buy’) price. The ‘bid’ is the price at which you sell the base currency, and the ‘ask’ is the price at which you buy the base currency. The difference between these two prices is what we call the spread.

When a trade is opened

There are always third parties who facilitate the opening and closing of that trade, like a bank or a liquidity provider. These third parties must make sure that there is an orderly flow of buy and sell orders, which means that they have to find a buyer for every seller and vice versa.

The third party is accepting the risk of a loss while facilitating the trade, thus the reason the third party will retain a part of each trade – that retained part is called the spread!

HOW DO YOU

CALCULATE THE SPREAD?

The spread itself is measured in ‘pips’, which is the smallest unit of price movement of a currency pair. So, the spread in the below example is 0.2 Pips.

Vì vậy, mức chênh lệch trong ví dụ dưới đây là 0,2 Pips.

HOW DO YOU

YOUR TRANSACTION COST ?

To work out the cost of the trade itself (not including overnight fees, commissions, etc.), you take the spread and pip value and multiply it by the number of lots you are trading: Trade Cost = Spread X Trade Size X Pip Value

*Example: The trade you opened has a spread of 1.2 pips. In this example, you are trading with mini lots of 10,000 base units. The pip value is at $1, so the transaction cost is $1.20

As you may have gathered, the larger the transaction, the greater your transaction costs will be!

WHAT IS SWAPS?

Quite simply, swaps are an overnight interest charge that traders must pay to hold a position open overnight. When a trader wants to keep a position open, they will pay interest on the currency sold, and receive interest on the currency bought. So, the swaps are derived from the interest rates of the countries involved in the currency pair, whether the trader is going long or short and the current market conditions.

IMPORTANT

SWAP/ROLLOVER RATE FACTS

- Swap rates are applied at 00:00 platform time.

- Each currency pair has its own swap fees and is measured on a standard size of 1 lot (100,000 base units).

- Swaps are applied each night to your open positions, and when the position is left open, it will have a new “day value”. However, on Wednesday night, the new value date for a trade held open was changed to Monday. Therefore, overnight fees are charged at three times the rate.

- Check your swaps on your MT5 Market Watch dashboard. You simply right-click, select ‘symbols’, select the instrument and then select ‘Properties’.

START TRADING

IN 4 STEPS

CFDs are complex instruments,and there is a high risk of losing money.

Register 🠖

Apply for your FXLINK Direct

Verify 🠖

Submit your ID and Proof of Residency and get verified

Fund

Deposit Funds in your live account

Trade

Enjoy being a part of the global financial markets

Tiếng Việt

Tiếng Việt Malaysia

Malaysia Français

Français 中文 (中国)

中文 (中国) ភាសាខ្មែរ

ភាសាខ្មែរ Bahasa Indonesia

Bahasa Indonesia Español

Español ไทย

ไทย